Incentive Marketing - Using Gifts to Advance Company Goals

Incentive marketing is a multifunctional tool within company management. Incorporating gifts into a company’s corporate culture can be highly advantageous across a variety of areas. Gift incentives can be used to, for example, promote customer or employee loyalty, boost motivation, productivity or sales, implement branding or employer branding strategies, and acquire new or recapture former clients.

In today’s business world, we have a broad range of possibilities and strategies by which to promote company goals through gifts and discounts. Of course, this is not necessarily an entirely simple process, with the tax authorities keeping a very close eye on such transfers. We provide you with an overview of the various incentive marketing options and their tax implications.

What Is Incentive Marketing?

Incentive marketing can take many different forms. You will generally need to differentiate between gifts to company members and employees, and gifts to customers and business partners, as the financial authorities do this too. Irrespective of who the recipient is, incentives can take the form of

- gift cards,

- tickets for events (sports events, concerts, etc.),

- travel,

- electronic items (tablets, games consoles, etc.),

- luxury items (watches, jewelry, perfume, etc.),

- employee benefits (company sauna, childcare, company mobile phone, massages, flexible working hours, sports vouchers, …),

- monetary rewards,

- discounts and special conditions,

- hospitality,

- or team excursions.

As the list shows, there is a lot of room for creativity when it comes to designing incentives. And this is good, because you want your incentives to stand out from the rest. It is important to ensure in this respect that the benefit selected is suited both to the giver and the recipient, and that it clearly serves the company’s interests.

What are Incentives Good For?

Incentives serve as rewards and as expressions of appreciation. Current studies show how important expressions of appreciation are to employees. Indeed, many employees feel praise and positive feedback for good work to be even more important that monetary rewards. Incentives are therefore an extremely effective way of boosting employee loyalty and motivation. When it comes to customers and business partners, the primary goal of incentive marketing is to promote a positive image of your company and to strengthen business relations. Incentive measures naturally also serve to boost productivity, sales and growth. Incentive marketing is strategic. Each benefit aims to advance a specific goal that, in turn, serves the interests of the company a whole. It therefore makes sense to focus resources for incentive marketing primarily on the employees, business partners and customers working within a company’s most promising areas.

What are the Tax Consequences of Incentive Marketing?

The tax authorities have lots of different names for the benefits given by companies to their customers and employees, among them special advantages, rewards, benefits-in-kind and gifts. Behind these different names, however, is basically the same idea. When incentives are given, they both incur expenditure and generate income. If income in the form of incentives is not insignificant, then it must be taxed in the same way as monetary income. The giver can record costs incurred through the incentive as business-related expenses and deduct these from its taxable income. The tax authorities, in turn, need to make sure that the public purse receives what the laws entitle it to. From this point on, things get a little complicated. The above list of different incentive forms shows that, from a tax perspective, there are numerous different ways in which the giver, the recipient and the benefit can interact with each other in a business context. The tax implications depend on

- whether the recipient is an employee, a client or a business partner,

- the context in which the benefit was given and the purpose it served,

- the value to be attributed to the benefit,

- what tax-free allowances apply to the type of transfer concerned.

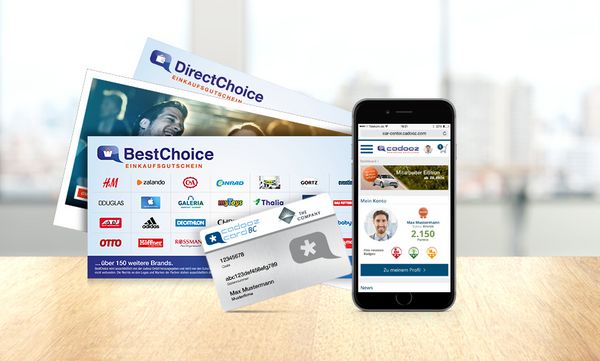

For example, incentive expenses of up to 44 euros per employee per calendar month are exempt from tax. The laws also allow for a wide variety of other ways in which to promote employee loyalty and motivation through incentives. Companies can, for example, grant reimbursements, subsidies, discounts, or allowances without incurring any tax liabilities. The legal circumstances surrounding such benefits are of course complex. They are, moreover, not always uniform. It is therefore essential that companies plan their incentive marketing carefully, paying close attention to the pertinent tax implications. Thankfully, there are ways and means of combining different incentive components so as to keep the workload involved to a minimum. Two such examples are the cadooz BestChoice ShoppingGiftCard and the cadoozCard.

Pooling Tax-Free Benefits and Incentives Strategically With cadooz

Many of the available incentive components and state subsidies can be combined well with one another to be able to grant employees, clients and business partners attractive tax-free benefits. This is the intention behind the cadoozCard. The rechargeable card enables you to grant your employees various incentives and allowances without incurring any tax liabilities. These can include benefits relating to Internet use and new media, holiday and travel cost allowances, and employee gifts.

There are many further ways of simplifying and optimizing your incentive management. We can provide you with corresponding advice and support. To contact us, use our contact form or simply give us a call!

Comments are disabled for this post.

0 comments